Artificial Intelligence (AI) continues to shape the trajectory of technological evolution, with major corporations investing heavily in new infrastructure, tools, and research to remain at the cutting edge of this rapidly advancing field. Two of the most influential developments in recent months come from OpenAI and Bloomberg—both highlighting the substantial capital and strategic thought now being committed to AI. OpenAI’s record-breaking $40 billion funding round, led by SoftBank, and Bloomberg’s push to revolutionize data analysis through generative AI are central indicators of how AI is evolving into an essential pillar of modern industry.

OpenAI’s Significant Funding Round

In a monumental move that underscores the growing confidence in artificial intelligence, OpenAI has secured $40 billion in a funding round spearheaded by SoftBank, elevating the company’s valuation to an unprecedented $300 billion. This infusion of capital positions OpenAI as one of the most valuable AI companies in the world and sets the stage for a new wave of AI research, infrastructure development, and enterprise solutions.

OpenAI, already renowned for its GPT series and ChatGPT, has made significant inroads into mainstream AI usage, from customer service chatbots to sophisticated coding assistants and enterprise analytics tools. With this new round of funding, the company intends to further accelerate its research in artificial general intelligence (AGI), scale up its cloud and computing infrastructure, and develop broader AI tools for both consumers and enterprises.

The “Stargate” Project

A particularly notable initiative that will benefit from this capital is “Stargate,” a joint effort between OpenAI, SoftBank, and Oracle. Stargate is envisioned as a cutting edge AI infrastructure project that will significantly expand computing capacity for training and deploying large-scale AI models. While full details of Stargate remain confidential, insiders describe it as a moonshot project focused on overcoming the bottlenecks that currently limit the speed and scope of AI development.

Stargate is anticipated to include custom-built data centers powered by renewable energy, statemof the art networking technology, and chip level optimization to support next-generation AI workloads. Oracle’s cloud infrastructure expertise and SoftBank’s global network and capital backing create a potent combination that could redefine what’s possible in the AI space.

Implications of the Investment

This funding round not only provides OpenAI with financial firepower but also signals to the global market that AI is entering a hyper growth phase. The enormous valuation implies long term investor confidence in OpenAI’s ability to commercialize its research and maintain leadership in AI innovation. It also reflects a broader industry trend: AI is no longer seen merely as an experimental technology but rather as a foundational element of future economic infrastructure.

The $40 billion figure is more than just a number; it is a clear message that AI is now central to the strategy of some of the world’s most influential investors. This move could trigger a cascade of follow up investments into AI startups, infrastructure providers, and chip manufacturers. Companies across sectors, from healthcare to finance, may also increase their AI adoption rates, hoping to keep pace with the advancements that companies like OpenAI are set to unleash.

Bloomberg’s AI Integration

While OpenAI focuses on the backbone of AI infrastructure, Bloomberg is pioneering the integration of AI directly into daily financial operations. According to Shawn Edwards, Bloomberg’s Chief Technology Officer, the company is deploying generative AI tools designed to reduce up to 80% of the workload of analysts by automating the processing of unstructured data.

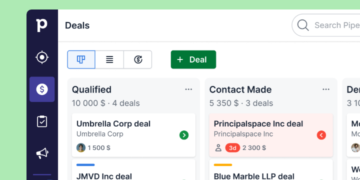

This move is significant not just because of the technology involved, but because of who is implementing it. Bloomberg, a stalwart in financial services and data analytics, has long been synonymous with precise and timely market information. Its Bloomberg Terminal is a cornerstone tool used by financial professionals worldwide. Incorporating generative AI into such a critical system reflects an evolution in how intelligence is derived and delivered in financial contexts.

Transforming Data Analysis

Financial analysis often involves sifting through enormous amounts of unstructured data, earnings calls, regulatory filings, press releases, and social media to extract actionable insights. This process is time-consuming and subject to human error. By implementing AI models capable of natural language processing (NLP) and pattern recognition, Bloomberg aims to automate much of this groundwork, freeing analysts to focus on higher-order strategic tasks.

The anticipated result? A tenfold increase in research productivity, according to Edwards. By automating data ingestion, tagging, summarization, and sentiment analysis, AI enables faster and more accurate decision-making. Moreover, these tools can work 24/7, ensuring that markets are monitored continuously without the limitations of human fatigue.

Generative AI in Financial Contexts

One of the most intriguing applications of generative AI in Bloomberg’s strategy is the creation of real-time reports and predictive models. For instance, the AI can generate narrative explanations of market moves or earnings performance, complete with context and comparative analysis. These narratives can be instantly translated into multiple languages, providing global clients with personalized insights faster than ever before.

Additionally, Bloomberg is exploring the use of AI in portfolio optimization, credit risk assessment, and fraud detection. The integration of machine learning and deep learning algorithms into existing platforms has the potential to transform how financial institutions approach risk and opportunity.

Human-AI Collaboration

Despite fears of job displacement, Bloomberg emphasizes that its AI tools are designed to augment human analysts rather than replace them. Edwards notes that while AI can handle repetitive or data-heavy tasks, strategic thinking, relationship-building, and ethical judgment still require human intelligence. The goal is to create a collaborative environment where humans and AI systems complement each other’s strengths.

Training programs and upskilling initiatives are also being rolled out to ensure Bloomberg’s workforce can effectively leverage these new tools. The firm is investing in internal AI literacy, ensuring that its professionals understand not just how to use AI, but also how to question its outputs and identify biases.

Broader Industry Impact

The combined initiatives from OpenAI and Bloomberg represent two sides of the same coin: foundational AI development and practical AI application. Together, they highlight a shift in how businesses view AI, not as a side project or R&D experiment, but as a central pillar of their future growth strategies.

The capital backing of OpenAI’s projects suggests a long-term vision where AI becomes an indispensable utility akin to electricity or the internet. Meanwhile, Bloomberg’s integration efforts show that such visions are already being implemented in practical, measurable ways.

Together, these developments may serve as a blueprint for other industries. Healthcare firms could adopt generative AI to parse medical literature or patient records. Manufacturing companies might use it to monitor supply chains in real time. Even education and public policy could benefit from faster, more reliable data synthesis enabled by AI.

Conclusion

Industry investments and developments in AI, as demonstrated by OpenAI’s landmark funding round and Bloomberg’s AI-driven transformation, are accelerating the global transition toward an AI-augmented future. These moves signify not just confidence in AI’s potential, but an understanding that the time to invest and implement is now. With massive financial backing, strategic collaborations, and real-world applications, the AI revolution is no longer on the horizon, it’s already here, reshaping how the world works, thinks, and evolves.